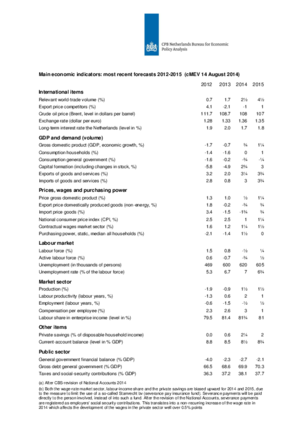

Preliminary table Main Economic Indicators 2012-2015 (14 August 2014)

Updated CPB forecast 2014-2015

Political tensions around the Ukraine and the Middle East are an increasing risk to world trade and, thus, also to the Dutch economy. For these projections, no further escalation of the Ukraine conflict has been assumed. In case of such further escalation, the growth in Dutch GDP in 2015 could turn out between ¼% and ½% lower (for an indication of the other first-year effects consistent with ½% less growth, see the first column of the table in the text box on page 10 of the Central Economic Plan 2014).

According to these intermediate projections, the Dutch economy is developing as was expected in last June’s projections. Expectations are slightly less favourable for world trade, due to disappointing realisations and the consequences of the political tensions around the Ukraine and Russia. Projected GDP growth, on balance, remains unchanged, as the revised National Accounts will have a small upward impact on growth. Employment is projected to decrease this year by ½% and to increase next year by ½%. Unemployment will continue to increase slightly this year to a total of around 620,000 people, while for 2015 a slight decrease to 605,000 is expected. This brings unemployment to a lower level than according to the June projections; particularly, as a result of a stronger declining labour supply in 2014. Inflation remains low and wage increases will be moderate. Median purchasing power in 2014 will increase by 1½%, particularly due to policy, and will be constant next year.

The government deficit is projected to increase, from 2.3% of GDP last year, to 2.7% in 2014. This is partly due to the fact that a number of special circumstances no longer exist, such as in particular the telecom auction of 2013 and lower natural gas profits. For next year, the deficit is projected to come down to 2.1% of GDP. The revised National Accounts lead to a downward adjustment of the government debt and the public financial burden and expenditure over the period of the projections. On balance, the revision has a small attenuating impact on the government deficit. The deficit furthermore was adjusted downwards due to lower social security expenditures, partly as a result of lower unemployment, and due to tax increases to compensate for lower healthcare premiums.

CPB, at this time, does not provide any further elaboration of these intermediate projections. On Prinsjesdag – the opening day of Parliament; this year on 16 September – CPB will publish its Macro Economic Outlook (MEV) 2015, with an elaboration and explanation of these projections as well as a detailed analysis of the Dutch economic situation.

Read the accompanying press release.

Table 'Main economic indicators', 2012-2015 (14-8-2014)

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Relevant world trade volume (%) | 0.7 | 1.7 | 2 1/2 | 4 1/2 |

| Export price competitors (%) | 4.1 | -2.1 | -1 | 1 |

| Crude oil price (Brent, level in dollars per barrel) | 111.7 | 108.7 | 108 | 107 |

| Exchange rate (dollar per euro) | 1.28 | 1.33 | 1.36 | 1.35 |

| Long-term interest rate the Netherlands (level in %) | 1.9 | 2.0 | 1.7 | 1.8 |

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Gross domestic product (GDP, economic growth, %) | -1.7 | -0.7 | 3/4 | 1 1/4 |

| Consumption households (%) | -1.4 | -1.6 | 0 | 1 |

| Consumption general government (%) | -1.6 | -0.2 | -3/4 | -1/4 |

| Capital formation including changes in stock (%) | -5.8 | -4.9 | 2 3/4 | 3 |

| Exports of goods and services (%) | 3.2 | 2.0 | 3 1/4 | 3 3/4 |

| Imports of goods and services (%) | 2.8 | 0.8 | 3 | 3 3/4 |

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Price gross domestic product (%) | 1.3 | 1.0 | 1/2 | 1 1/4 |

| Export price domestically produced goods (non energy, %) | 1.8 | -0.2 | -3/4 | 3/4 |

| Import price goods (%) | 3.4 | -1.5 | -1 3/4 | 3/4 |

| National consumer price index (CPI, %) | 2.5 | 2.5 | 1 | 1 1/4 |

| Contractual wages market sector (%) | 1.6 | 1.2 | 1 1/4 | 1 1/2 |

| Purchasing power, static, median all households (%) | -2.1 | -1.4 | 1 1/2 | 0 |

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Labour force (%) | 1.5 | 0.8 | -1/2 | 1/4 |

| Active labour force (%) | 0.6 | -0.7 | -3/4 | 1/2 |

| Unemployment (in thousands of persons) | 469 | 600 | 620 | 605 |

| Unemployed rate (% of the labour force) | 5.3 | 6.7 | 7 | 6 3/4 |

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Production (%) | -1.9 | -0.9 | 1 1/2 | 1 1/2 |

| Labour productivity (labour years, %) | -1.3 | -0.6 | 2 | 1 |

| Employment (labour years, %) | -0.6 | -1.5 | -1/2 | 1/2 |

| Compensation per employee (%) | 2.3 | 2.6 | 3 | 1 |

| Labour share in enterprise income (level in %) | 79.5 | 81.4 | 81 3/4 | 81 |

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Private savings (% of disposable household income) | 0.0 | 0.6 | 2 1/4 | 2 |

| Current-account balance (level in % GDP) | 8.8 | 8.5 | 8 1/2 | 8 3/4 |

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| General government financial balance (% GDP) | -4.0 | -2.3 | -2.7 | -2.1 |

| Gross debt general government (% GDP) | 66.5 | 68.6 | 69.9 | 70.3 |

| Taxes and social security contributions (% GDP) | 36.3 | 37.2 | 38.1 | 37.7 |

Both the wage-rate market sector, labour-income share and the private savings are biased upward for 2014 and 2015, due to the measure to limit the use of a so-called Stamrecht bv (severance pay insurance fund). Severance payments will be paid directly to the person involved, instead of into such a fund. After the revision of the National Accounts, severance payments are registered as employers' social security contributions. This translates into a non-recurring increase of the wage rate in 2014 which affects the development of the wages in the private sector well over 0.5% points.