February 13, 2020

Are the savings of Dutch households optimal?

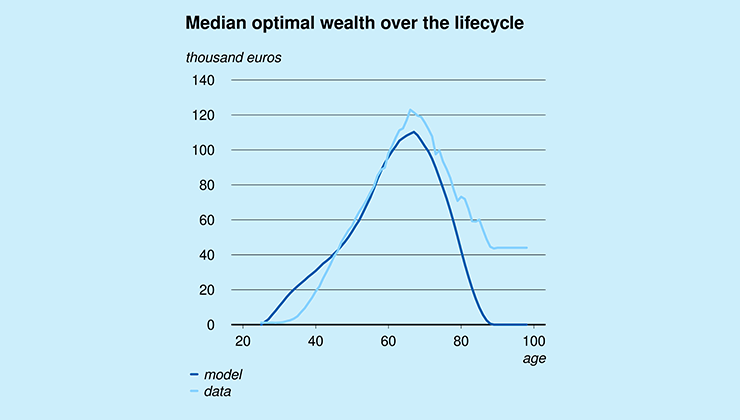

Dutch households (implicitly) have an unusual mix of assets. Particularly their high level of mortgage debts and pension entitlements stand out in an international context. In this paper we examine how Dutch household wealth compares to the theoretically optimum. In general we find that Dutch households do not save too much. At retirement age, the median optimum assets are roughly the same as the median observed net assets of Dutch households. However the differences between households can be substantial. in particular have more assets than is optimal according to the model. Their observed wealth remains constant or sometimes even increases after retirement.

We also find that many Dutch households have too few liquid assets to be able to cushion the effects of an unexpected fall in income. The data shows that most Dutch household wealth is held in their own homes, which is illiquid. Finally, we note that many older households

The optimum wealth that we present is not intended as a normative recommendation; it is not advice to individual households. Our result depends on assumptions about preferences, parameters and the model choices made. Actual optimum wealth is uncertain and will be different for every household. In the memorandum we include sensitivity analyzes based on different assumptions and parameter values.

Downloads

Pdf, 6.4 MB

Authors