Forecast September 2017 (MEV 2018)

Flourishing economy; tighter labour market

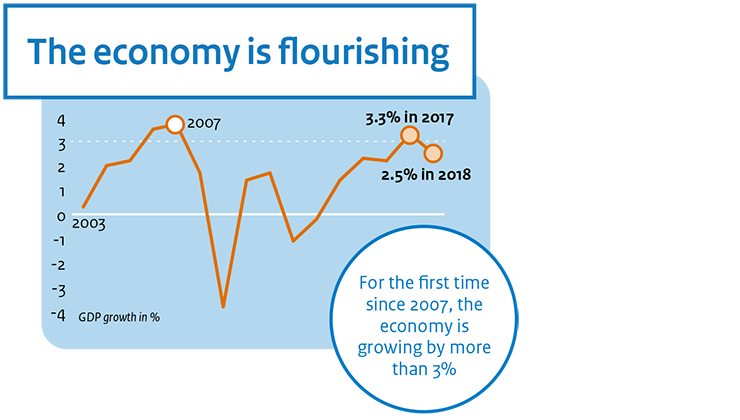

The Dutch economy is growing across the board. Increases in the export of goods are above average, consumption is benefiting from the increase in employment, and companies are increasing their investments, in order to meet the large demand. The very active housing market has elevated the level of housing investment, although this will slow down in the coming years – due to the far-advanced catch-up process on the housing market and labour shortages in certain parts of the construction sector.

Developments on the labour market are plainly positive. Employment is rising, as are the numbers of labour hours per employed person. There are also more job vacancies. For the time being, these favourable circumstances are expected to continue, causing the tightness of the labour market to increase. This will improve the position of the employed compared to that of the employers, which is likely to lead to improvements in labour conditions by way of higher wages, more permanent employment contracts besides flexible contracts, and higher tariffs for independent professionals.

As a result of the continuing economic growth and related increases in tax revenues and decreases in unemployment benefit expenditures, the budget surplus is projected to increase in both 2017 and 2018.

Projected surpluses are larger than those over the 2006–2008 period, as well as those elsewhere in the eurozone. For the coming year, all population groups included in CPB’s projections, on average, are projected to see an increase in purchasing power. Median purchasing power, in 2018, is projected to increase the most for the employed (+0.8%), while pensioners will experience an 0.6% increase in income, and benefit recipients will also have 0.3% more to spend, next year.

On a global level, the economy is projected to grow by 3.4% in 2017, and by 3.6% in 2018. For the eurozone, this will be 2.0% in 2017 and 1.8% in 2018. The increasing economic growth involves an increase in world trade. These favourable circumstances are surrounded by uncertainties, both globally and within Europe. This relates, among other things, to the European Central Bank’s monetary policy, insolvent banks in Italy, Brexit, US financial policy, and geo-political tensions around North Korea. In addition to these downward risks, the current economic upturn in Europe and the United States may also be underestimated.

In its MEV report, CPB also concludes that the general perception of the Dutch education system being excellent for pupils who are lagging behind should be revised. The Netherlands currently ranks somewhere in the European middle, where this concerns pupils who have not completed an intermediate vocational education (mbo-2), higher general secondary (havo) or pre-university (vwo) education. This seems to call for additional policy that is focused on unlocking the potential in less-talented people.

In this publication CPB presents its analyses and projections of both the Dutch and worldwide economy in 2017 and 2018. The Outlook is only published in Dutch, the download is a translation of chapter 1 of the Dutch publication.

Downloads

Tekstkaders in MEV 2018

- Groene signalen tegen een grijze achtergrond

- Barsten in de bankenunie?

- ECB: shop till you drop?

- Onzekerheid rondom de raming

- Onzekere tijden zijn lastig te voorzien

- Hoogopgeleide ouderen: vroeger met pensioen én vaker aan het werk

- Eind van zwakke loonontwikkeling komt in zicht

- Berekeningswijze arbeidsinkomensquote aangepast

- De invoering van het kwaliteitskader verpleeghuiszorg

- Inkomensongelijkheid in perspectief

- Van economische groei naar koopkrachtstijging

Fan Charts September 2017

The figures present fan charts around the MEV 2018 point forecasts for GDP growth, HICP inflation, unemployment and general government financial balance.

The solid line represents data realizations (2012-2016) and the MEV 2018 point forecasts for 2017 and 2018. Around the central path the figures present a fan of confidence intervals:

• 30% confidence interval from the 35th to 65th percentile, dark blue area

• 60% confidence interval from the 20th to 80th percentile, dark blue + blue area

• 90% confidence interval from the 5th to 95th percentile, dark blue + blue + light blue area

The probability is thus 30% that the outcome will fall in the dark blue area and the probability is 10% that the outcome will fall outside the fan. In other words, the fan is a graphical representation of the likelihood of the various outcomes. The solid line represents the most likely outcome and outcomes are more likely when they are closer to the solid line.

Downloads

Contacts

Met de certificering wordt invulling gegeven aan het advies in het rapport van de Studiegroep Begrotingsruimte.

In deze CPB Notitie zijn in totaal 65 ramingen gecertificeerd. Hiervan hebben er eenentwintig een mogelijk budgettair effect. Voor deze maatregelen wordt tevens een inschatting van de onzekerheid gemaakt. Na de marginale beoordeling zijn, in overeenstemming met het toetsingskader vier maatregelen uitvoerig beoordeeld. Tabellen 1 en 2 geven een overzicht van alle gecertificeerde maatregelen. In de navolgende paragraaf wordt de certificering van en de onzekerheidsanalyse voor enkele specifieke ramingen toegelicht.

Authors

Voor de bekostiging van uitkeringen op grond van de Participatiewet ontvangen gemeenten een budget. De hoogte van het budget wordt bepaald op basis van een raming voor het aantal uitkeringsgerechtigden en de gemiddelde hoogte van een uitkering. Het CPB publiceert ramingen van het aantal bijstandsuitkeringen in het lopende en komende jaar in het Centraal Economisch Plan (CEP) in maart en in de Macro Economische Verkenning (MEV) in september. Het uitgangspunt in de raming is de ramingsregel die het verband weergeeft tussen mutaties in de werkloze beroepsbevolking (WBB) en de mutatie in de bijstand.

Paragraaf 2 geeft een onderbouwing van de bijstandsraming in de MEV 2018 voor het jaar 2017. Paragraaf 3 bevat een vooruitblik naar 2018. De werking van de ramingsregel wordt toegelicht in een tekstkader.

Authors

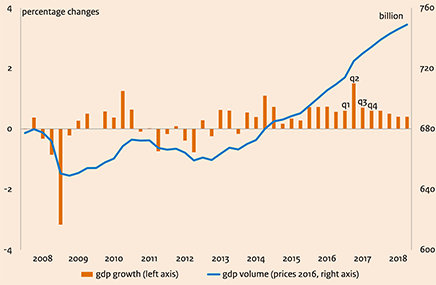

Economic growth in the Netherlands, 2008-2018

>

Downloads

Table 'Main economic indicators', 2015-2018 (a)

| 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|

| Relevant world trade volume goods and services (%) |

3.8 |

3.6 |

4.3 |

4.0 |

| Export price competitors (goods and services, non-commodities, %) |

7.9 |

-3.7 |

0.6 |

0.0 |

| Crude oil price (dollar per barrel) |

51.9 |

43.3 |

49.3 |

49.5 |

| Exchange rate (dollar per euro) |

1.11 |

1.11 |

1.11 |

1.14 |

| Long-term interest rate the Netherlands (level in %) |

0.7 |

0.3 |

0.6 |

0.8 |

| 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|

| Gross domestic product (GDP, economic growth, %) |

2.3 |

2.2 |

3.3 |

2.5 |

| Consumption households (%) |

2.0 |

1.6 |

2.2 |

2.4 |

| Consumption general government (%) |

-0.2 |

1.2 |

0.6 |

1.6 |

| Capital formation including changes in stock (%) |

11.2 |

3.1 |

6.3 |

4.8 |

| Exports of goods and services (%) |

6.5 |

4.3 |

4.9 |

4.5 |

| Imports of goods and services (%) |

8.4 |

4.1 |

4.5 |

5.1 |

| 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|

| Price gross domestic product (%) |

0.8 |

0.6 |

1.1 |

1.6 |

| Export price goods and services (non-energy, %) |

1.5 |

-0.9 |

1.0 |

0.3 |

| Import price goods (%) |

-5.4 |

-4.4 |

3.6 |

-0.5 |

| Inflation, harmonised index of consumer prices (hicp, %) |

0.2 |

0.1 |

1.3 |

1.3 |

| Compensation per hour private sector (%) |

-0.2 |

0.6 |

2.2 |

3.2 |

| Contractual wages private sector (%) |

1.2 |

1.5 |

1.6 |

2.2 |

| Purchasing power, static, median, all households (%) |

1.0 |

2.7 |

0.3 |

0.6 |

| 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|

| Labour force (%) |

0.4 |

0.4 |

0.8 |

1.1 |

| Active labour force (%) |

1.0 |

1.3 |

2.0 |

1.7 |

| Unemployment (in thousands of persons) |

614 |

538 |

440 |

390 |

| Unemployed rate (% of the labour force) |

6.9 |

6.0 |

4.9 |

4.3 |

| Employment (hours, %) |

0.6 |

2.0 |

2.0 |

1.6 |

| 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|

| Labour share in enterprise income (level in %) |

72.2 |

72.9 |

72.5 |

73.0 |

| Labour productivity private sector (per hour, %) |

1.5 |

0.4 |

1.5 |

1.0 |

| Private savings (% of disposable household income) |

-0.4 |

0.3 |

0.3 |

0.5 |

| Current-account balance (level in % GDP) |

8.3 |

8.7 |

8.8 |

8.5 |

| 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|

| General government financial balance (% GDP) |

-2.1 |

0.4 |

0.6 |

0.8 |

| Gross debt general government (% GDP) |

64.6 |

61.8 |

57.2 |

53.7 |

| Taxes and social security contributions (% GDP) |

37.3 |

38.7 |

38.8 |

38.9 |

| Gross government expenditure (% GDP) |

45.2 |

43.8 |

43.0 |

42.5 |

(a) CPB uses as of MEV 2018 a new method for the calculation of the labour share in enterprise income. This new method takes better account of the income of self-employed persons and therefore better matches current economic reality. A joint 'notitie' of CBS, CPB and DNB is available on this subject (only in Dutch).