Projections February 2024 (CEP 2024)

CPB projections: purchasing power restored, public finances need a course correction

CPB Director Pieter Hasekamp: “A wage catch-up and lower inflation mean households will have more to spend again. With a view to the future, however, it is important that the government puts its finances on a sounder footing. Policy ambitions must include clear choices to address the rising government deficit, as well as labour market shortages and the lack of space.”

Purchasing power and poverty

The median purchasing power will increase sharply by 2.7% this year. All income groups will see an improvement in the period ahead. The result is that the median purchasing power in 2025 will still be 0.5% below the 2021 level, before the energy crisis. There has been a clear improvement for low income groups over that period, however. This is because they have benefited from the increase in the statutory minimum wage and associated welfare benefits, the increased rental allowance, labour tax credits and the child-related budget. Higher income groups have seen their purchasing power decline on average over the same period. The above policy measures will also reduce the number of people and children living in poverty in 2024.

| 2023 | 2024 | 2025 | |

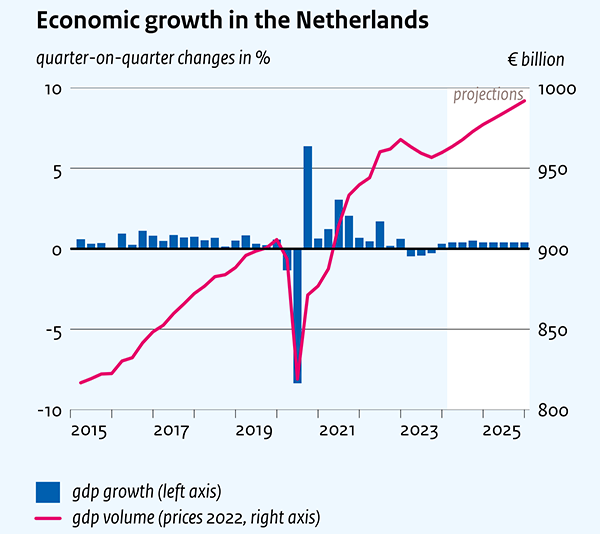

| GDP returns to moderate growth trajectory | 0.1% | 1.1% | 1.6% |

| Purchasing power recovers due to rising wages and falling inflation | -0.8% | 2.7% | 0.0% |

| Inflation falls rapidly after major price shocks | 3.8% | 2.9% | 2.8% |

| Persons below the poverty line | 4.8% | 4.7% | 4.9% |

| Unemployment rises slightly, but labour market remains tight | 3.5% | 3.7% | 3.9% |

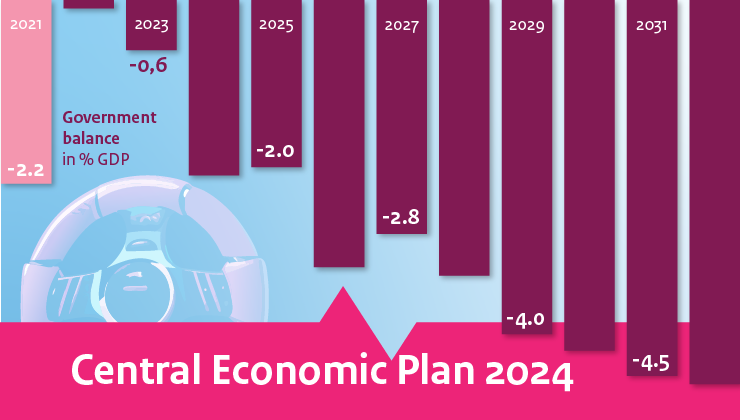

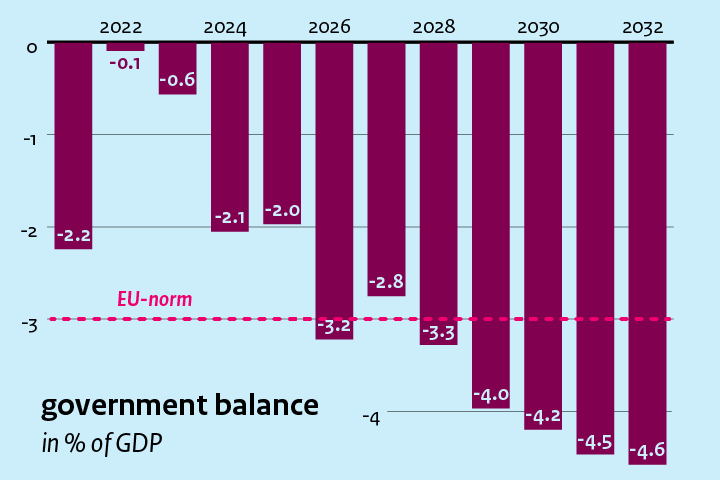

Public finances

On the basis of unchanged policy, the government deficit will rise significantly. According to this projection, the government deficit will be 3.3% of GDP in 2028 and 4.6% of GDP in 2032, well above the European limit of 3%. The increase is due to expenditure rising faster than taxes, notably due to increased spending on social security, healthcare, defence and interest. We also assume that the current underinvestment will end, causing the balance to deteriorate further. The course correction recommended last year by the official advisory group on budgetary options therefore remains necessary.

CEP part 2

CPB Netherlands Bureau for Economic Policy Analysis has today published the first part of the CEP. A further accountability document will be published on 28 February with more detailed background information and an analysis of the labour market shortages.

Downloads

.

Lees ook het Centraal Economisch Plan (CEP) 2024 en de Beschouwing

Contacts

De arbeidsmarkt is historisch krap. Dat heeft gevolgen voor heel veel bedrijven en organisaties en maakt het lastig om maatschappelijke uitdagingen op het gebied van bijvoorbeeld wonen, zorg, onderwijs en de energietransitie te realiseren. Naar verwachting zullen aanpassingsmechanismes op de arbeidsmarkt – hogere lonen, betere arbeidsvoorwaarden, productiviteitsstijging – de komende jaren de krapte doen afnemen. Deze aanpassing verloopt echter traag en leidt niet automatisch tot maatschappelijk gewenste uitkomsten. In specifieke sectoren zullen knelpunten blijven bestaan en voor met name de collectieve sector kan het lastig blijven om aan voldoende personeel te komen. Er ligt dus een mogelijke rol voor overheidsbeleid.

Arbeidsaanbod

Beleid gericht op extra arbeidsaanbod kan maar een beperkte rol spelen. Nederland heeft inmiddels de hoogste participatiegraad in de wereld. Het aantal gewerkte uren zou nog kunnen stijgen, maar de deeltijdcultuur is in Nederland diep geworteld. Vaak wordt de marginale druk genoemd als oorzaak, maar die speelt slechts een beperkte rol bij de beslissing om meer of minder te gaan werken. Belangrijker lijken sociale normen en die veranderen doorgaans langzaam. Arbeidsmigratie kan arbeidstekorten tijdelijk verminderen in sommige sectoren. Maar op langere termijn helpt migratie niet om de krapte op de arbeidsmarkt op te lossen. Meer arbeidsaanbod zorgt namelijk voor meer economische activiteit en daardoor stijgt de vraag naar arbeid vanzelf weer mee.

Vraagzijde

De echte oplossing zal moeten komen van de vraagzijde. En daar heeft de overheid zelf ook invloed op. De overheid kan de vraag naar arbeid doen afnemen door scherpe keuzes te maken in de aanpak van maatschappelijke uitdagingen en door de groei van de overheidsuitgaven te beperken. Aanvullend kan de overheid de arbeidsvoorwaarden, waaronder de lonen, in specifieke collectieve sectoren verbeteren, zodat het werken in bepaalde beroepen aantrekkelijker wordt ten opzichte van andere (private) sectoren. Tot slot kan worden ingezet op het bevorderen van productiviteit: waar mogelijk meer automatiseren, minder administratie en minder complexe wet- en regelgeving.

Gelijktijdig met deze beschouwing, is ook het verantwoordingsdocument gepubliceerd dat hoort bij het Centraal Economisch Plan 2024 (gepubliceerd op 22 februari). Die publicatie bevat een nadere onderbouwing van de raming op het vlak van de Nederlandse economie, de overheidsfinanciën, en koopkracht en armoede.

Contacts

Downloads

Main economic indicators, 2022-2025, February 2024

| 2022 | 2023 | 2024 | 2025 | |

| Relevant world trade volume goods and services (%) | 7.8 | -0.1 | 1.7 | 2.8 |

| Export price competitors (goods and services, non-commodities, %) | 15.7 | -2.4 | 3.6 | 2.0 |

| Crude oil price (level in dollar per barrel) | 100.9 | 82.6 | 76.4 | 73.2 |

| Exchange rate (level in dollar per euro) | 1.05 | 1.08 | 1.10 | 1.11 |

| Long-term interest rate the Netherlands (level in %) | 1.4 | 2.8 | 2.4 | 2.4 |

| 2022 | 2023 | 2024 | 2025 | |

| Gross domestic product (GDP, economic growth, %) | 4.3 | 0.1 | 1.1 | 1.6 |

| Household consumption (%) | 6.6 | 0.4 | 2.7 | 2.4 |

| Government consumption (%) | 1.6 | 2.6 | 3.2 | 0.9 |

| Capital formation (including changes in stock, %) | 1.0 | -0.7 | -3.1 | 2.3 |

| Exports of goods and services (%) | 4.5 | -1.2 | 0.6 | 2.5 |

| Imports of goods and services (%) | 3.8 | -0.7 | 1.1 | 3.0 |

| 2022 | 2023 | 2024 | 2025 | |

| Price gross domestic product (%) | 5.5 | 7.7 | 4.0 | 2.3 |

| Export price goods and services (%) | 17.4 | -0.7 | 1.1 | 1.5 |

| Import price goods and services (%) | 20.7 | -3.2 | -0.1 | 1.4 |

| Inflation, national consumer price index (CPI, %) | 10.0 | 3.8 | 2.9 | 2.8 |

| Alternative CPI (purchasing power and poverty figures) (%) (a) | 6.8 | 7.8 | 2.7 | 2.8 |

| Inflation, harmonised index of consumer prices (HICP, %) | 11.6 | 4.1 | 2.7 | 2.5 |

| Compensation per hour private sector (%) (b) | 3.7 | 6.9 | 6.3 | 4.2 |

| Wages as determined in collective labour agreements, private sector (%) | 3.1 | 5.9 | 6.0 | 3.9 |

| Purchasing power, static, median all households (%) (c) | -2.7 | -0.8 | 2.7 | 0.0 |

| People in poverty (level in %) (c,d) | 4.7 | 4.8 | 4.7 | 4.9 |

| 2022 | 2023 | 2024 | 2025 | |

| Labour force (%) | 2.4 | 2.0 | 1.0 | 0.7 |

| Active labour force (%) | 3.2 | 2.0 | 0.9 | 0.5 |

| Unemployment (in thousands of persons) | 350 | 358 | 380 | 405 |

| Unemployed rate (% of the labour force) | 3.5 | 3.5 | 3.7 | 3.9 |

| Employment (hours, %) | 3.9 | 0.5 | 0.6 | 0.6 |

| 2022 | 2023 | 2024 | 2025 | |

| Labour share in enterprise income private sector (level in %) | 71.5 | 70.0 | 70.8 | 71.3 |

| Labour productivity private sector (per hour, %) | 1.0 | -0.4 | 0.4 | 1.0 |

| Private savings (% of disposable household income) | 7.6 | 6.4 | 8.1 | 8.1 |

| Current-account balance (level in % GDP) | 9.3 | 10.1 | 10.3 | 10.1 |

| 2022 | 2023 | 2024 | 2025 | |

| General government financial balance (% GDP) | -0.1 | -0.6 | -2.1 | -2.0 |

| Gross debt general government (% GDP) | 50.1 | 46.5 | 46.8 | 48.1 |

| Taxes and social security contributions (% GDP) | 38.6 | 39.2 | 38.7 | 38.9 |

| Gross government expenditure (% GDP) | 43.7 | 43.5 | 44.4 | 44.6 |

(a) The alternative CPI takes into account prices of both new and existing energy contracts. See par. 1.4 of the 'Central Economic Plan-CEP-2023-Verdieping' (link) for more information on the alternative cpi series and see CBS (link).

(b) The NOW wage cost subsidy, and the continuity contribution to health care, have a downward effect of 1.6%-points in 2022.

(c) The alternative cpi has been taken into account for the median purchasing power figures and the persons in poverty.

(d) The ratio of the number of persons in households below the poverty line and the total number of persons. The modest-but-adequate budget of the Netherlands Institute for Social Research has been used as the poverty line.

Contacts