November 14, 2018

Can we measure banking sector competition robustly?

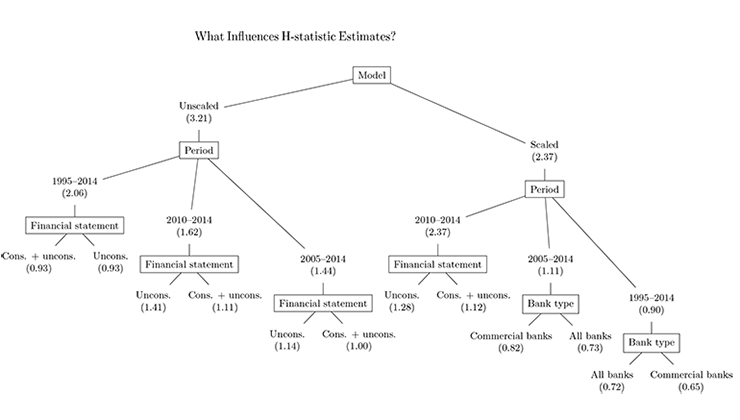

We discuss existing measures of banking competition along with their advantages and disadvantages. For the Panzar and Rosse H-statistic,we further investigate the robustness of its estimates. Specifically, we consider how the estimates vary with respect to modelling and data choices along the following dimensions: 1) bank types 2)consolidation codes 3)time periods 4) outliers 5)econometric models

We construct a robust H-statistic estimate following a modified DerSimonian and Laird procedure. We find that no robust conclusions can be drawn regarding the relative competitiveness of the banking industries in European countries, nor regarding the development of the aggregate level of competition in Europe over the past twenty years. This finding illustrates why there is little consensus about the H-statistic estimates despite numerous publications on the topic. Additionally, we check which dimensions are most important in driving the differences between the estimates and find that the choice of model specification plays the largest role.

Downloads

Pdf, 916.2 KB

Authors

Andrei Dubovik

Natasha Kalara