Search results

November 8, 2019

Gebruik (en niet-gebruik) van toeslagen in Nederland

June 26, 2019

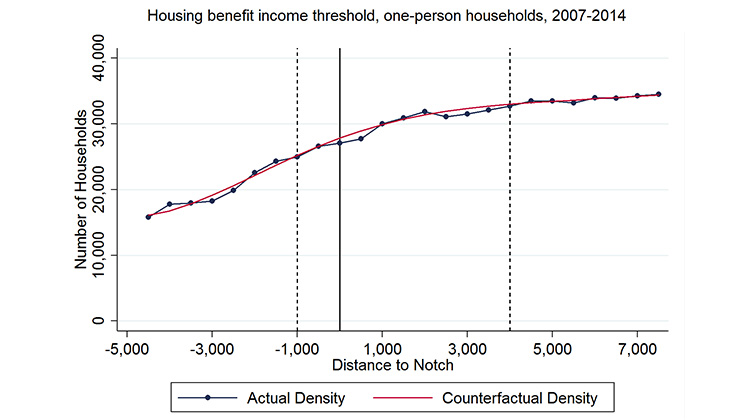

Non-Bunching at Kinks and Notches in Cash Transfers

January 21, 2019

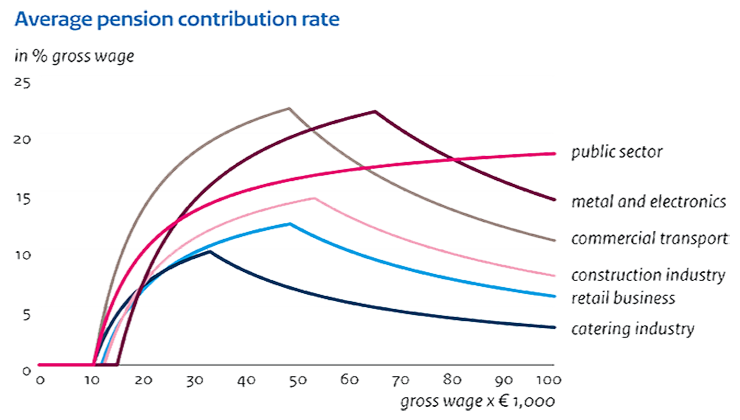

The Incidence of Pension Contributions

December 19, 2017