Search results

Optimal capital ratios for banks in the euro area

Capital buffers help banks to absorb financial shocks. This reduces the risk of a banking crisis. However, on the other hand capital requirements for banks can also lead to social costs, as rising financing costs can lead to higher interest rates for customers. In this research we make an exploratory analysis of the costs and benefits of capital buffers for groups of European countries. →

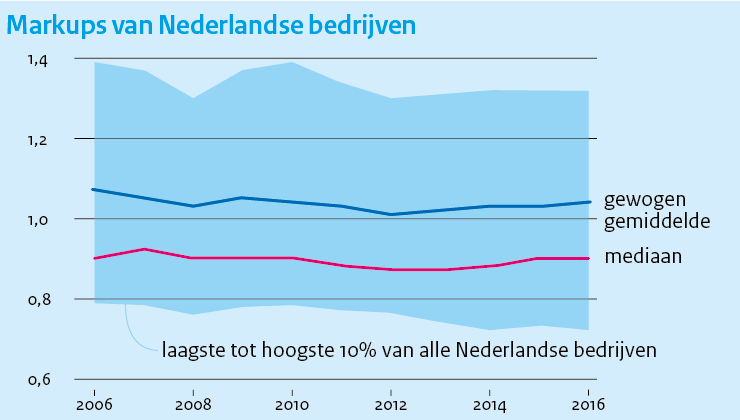

Markups van bedrijven in Nederland

Estimating Markups in the Netherlands

Frontier firms and followers in the Netherlands: estimating productivity and identifying the frontier

This study shows that constructing a large dataset, which sufficiently covers all firm sizes, is a prerequisite for studying the divergence hypothesis. We merge datasets of individual firm and employee data in the years 20062015 for the Netherlands, resulting in a representative sample of corporations. We find no evidence of diverging productivity between firms on the national frontier and laggard firms. →