Search results

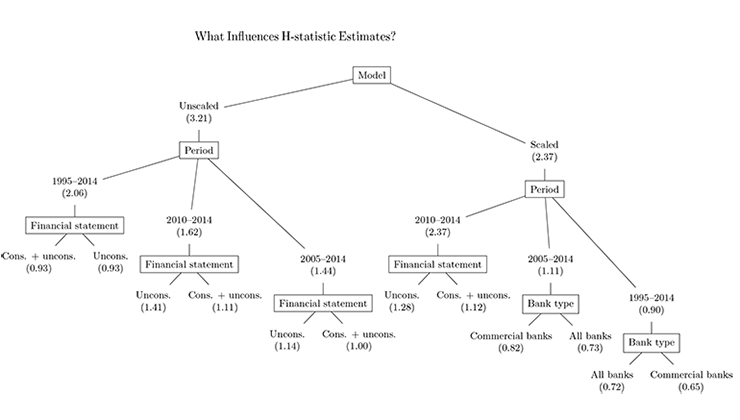

Can we measure banking sector competition robustly?

How do the Dutch Finance their Own House? – Descriptive Evidence from Administrative Data

We investigate the major financing components which are used to purchase a house in the Netherlands. This is important to shed more light on the effects of changing lending norms. We look at the full universe of housing transactions in the Netherlands by making use of administrative data from Statistics Netherlands (CBS) for the period 2006-2014. →

A Review on ESBies - The senior tranche of sovereign bond-backed securities

Safe assets, assets with low risk and high liquidity, are the cornerstone for modern financial systems. The biggest holders of safe assets are banks, which need to hold safe assets to meet capital and liquidity requirements. Safe assets also provide high-quality, liquid collateral for banks’ repo transactions. Besides, safe assets provide benchmarks for the price formation of other financial assets. →

Oververhitting op de Nederlandse huizenmarkt?

In dit CPB Achtergronddocument bij de Risicorapportage financiële markten 2018 gaan we nader in op recente ontwikkelingen op de Nederlandse woningmarkt. Speciale aandacht gaat uit naar de factoren die huizenprijzen op de korte en lange termijn verklaren en naar de vraag of oververhitting en bubbels wel vooraf te meten en te bepalen zijn. →

Towards an EMU banking union: three scenarios

Capital position of banks in the EMU: an analysis of Banking Union scenarios

This CPB Background Document provides details of the simulations of shocks to the capital position of banks in the EMU that underpins the Financial Risk Report 2018 of the CPB. This involves investigating the potential impact of two legacy problems on the capital position of banks. These problems are the high amount of government debt, especially in Italy, and the high level of non-performing loans on banks’ balance sheets. →

The effects of unconventional monetary policy in the euro area

Effects of Unconventional Monetary Policy on European Corporate Credit

In this paper we investigate whether the targeted longer-term refinancing operations (TLTRO) and the asset purchase program (APP) led to lower interest rates on new corporate credit, and whether the signalling channel and the capital relief channel played any role in the transmission of these ECB policies. →