Search results

Consument met hoge hypotheek houdt bij crisis hand op knip

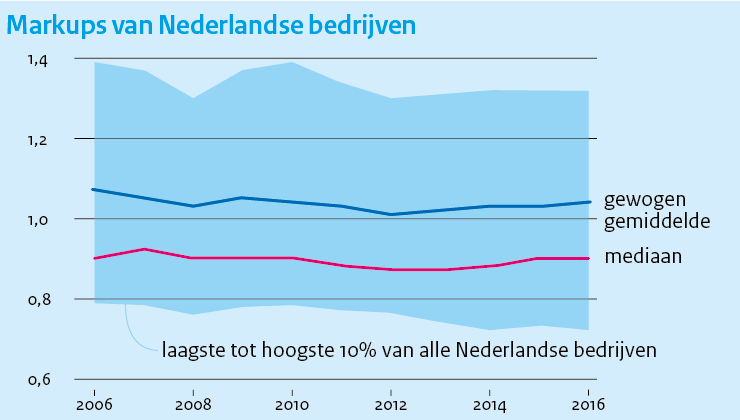

Markups van bedrijven in Nederland

Estimating Markups in the Netherlands

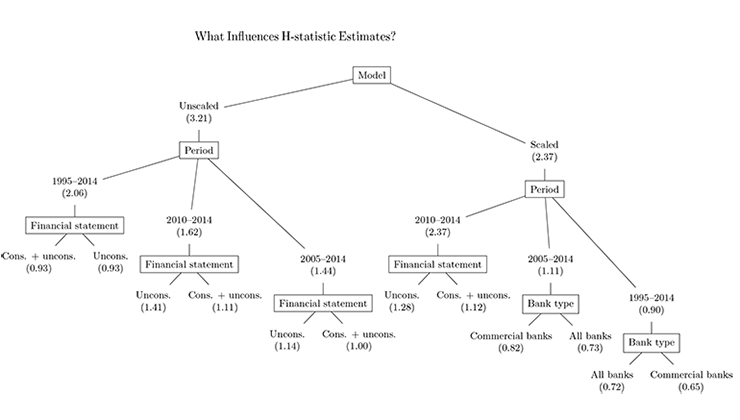

Can we measure banking sector competition robustly?

How do the Dutch Finance their Own House? – Descriptive Evidence from Administrative Data

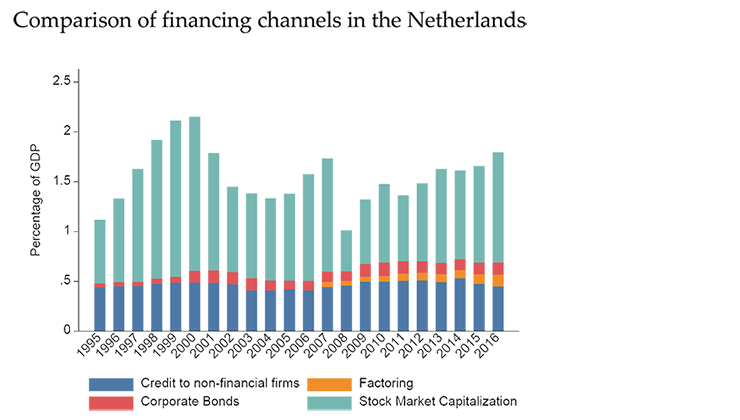

We investigate the major financing components which are used to purchase a house in the Netherlands. This is important to shed more light on the effects of changing lending norms. We look at the full universe of housing transactions in the Netherlands by making use of administrative data from Statistics Netherlands (CBS) for the period 2006-2014. →

A Review on ESBies - The senior tranche of sovereign bond-backed securities

Safe assets, assets with low risk and high liquidity, are the cornerstone for modern financial systems. The biggest holders of safe assets are banks, which need to hold safe assets to meet capital and liquidity requirements. Safe assets also provide high-quality, liquid collateral for banks’ repo transactions. Besides, safe assets provide benchmarks for the price formation of other financial assets. →

Oververhitting op de Nederlandse huizenmarkt?

In dit CPB Achtergronddocument bij de Risicorapportage financiële markten 2018 gaan we nader in op recente ontwikkelingen op de Nederlandse woningmarkt. Speciale aandacht gaat uit naar de factoren die huizenprijzen op de korte en lange termijn verklaren en naar de vraag of oververhitting en bubbels wel vooraf te meten en te bepalen zijn. →

Towards an EMU banking union: three scenarios

Capital position of banks in the EMU: an analysis of Banking Union scenarios

This CPB Background Document provides details of the simulations of shocks to the capital position of banks in the EMU that underpins the Financial Risk Report 2018 of the CPB. This involves investigating the potential impact of two legacy problems on the capital position of banks. These problems are the high amount of government debt, especially in Italy, and the high level of non-performing loans on banks’ balance sheets. →

Authors

- Beau Soederhuizen (14)

- Benedikt Vogt (14)

- Adam Elbourne (10)

- Fien van Solinge (9)

- Karen van der Wiel (7)

- Lu Zhang (7)

- Andrei Dubovik (6)

- Sander Lammers (6)

- Bert Kramer (5)

- Kan Ji (5)

- Sander van Veldhuizen (5)

- Bert Smid (4)

- Emile Cammeraat (4)

- Gerdien Meijerink (4)

- Harro van Heuvelen (4)

- Suzanne Vissers (4)

- Bart Voogt (3)

- Jeroen Hinloopen (3)

- Leon Bettendorf (3)

- Machiel van Dijk (3)

- Michiel Bijlsma (3)

- Natasha Kalara (3)

- Remco Mocking (3)

- Rob Luginbuhl (3)

- Rutger Teulings (3)

- Stefan Groot (3)

- Arjan Lejour (2)

- Bas Straathof (2)

- Bastiaan Overvest (2)

- Bram Hendriks (2)

- Hans Koster, VU (2)

- Henrik Zaunbrecher (2)

- Jennifer Buurma-Olsen (2)

- Jennifer Olsen (2)

- Joep Steegmans (2)

- Joep Tijm (2)

- Jort Sinninghe Damsté (2)

- Jos van Ommeren, VU (2)

- Jurre Thiel (2)

- Marcel Timmer (2)

- Matthijs Katz (2)

- Nicoleta Ciurila (2)

- Ona Ciocyte (2)

- Pim Kastelein (2)

- Anja Deelen (1)

- Anna Huizinga (1)

- Brinn Hekkelman (1)

- Clemens Kool (1)

- Daan Freeman (1)

- Douwe Kingma (1)

- Ed Westerhout (1)

- Fozan Fareed (1)

- Francis Weyzig (1)

- Friso Scheepstra (1)

- Hugo Rojas-Romagosa (1)

- Jochem Zweerink (1)

- Koen van Ruijven (1)

- Kristina Tranakieva (1)

- Luuk Metselaar (1)

- Marco Ligthart (1)

- Marielle Non (1)

- Mark van der Plaat (1)

- Maurits van Kempen (1)

- Nicole Bosch (1)

- Paul Verstraten (1)

- Petra Messelink (1)

- Ramy El-Dardiry (1)

- Raoul van Maarseveen (1)

- Rik Dillingh (1)

- Robert Schmitz (1)

- Rosa van der Drift (1)

- Rudi Duricic (1)

- Rudy Douven (1)

- Sem Duijndam (1)

- Thomas Michielsen (1)

- Wiljan van den Berge (1)

- Show all

Tags

- Risk and regulation (80)

- Macroeconomics (66)

- Financial markets (40)

- International analysis (22)

- Competition and regulation (17)

- Built environment (14)

- International economy (14)

- Public finances (14)

- Government (10)

- Labour (6)

- Physical environment (6)

- General welfare (5)

- COVID-19 (4)

- Health care (4)

- Productivity (4)

- Labour market (3)

- Taxation (3)

- Knowledge and Innovation (2)

- Welfare state (2)

- Climate and Environment (1)

- Data science team (1)

- Digital economy (1)

- Long-term outlook (1)

- Model quality (1)

- purchase power (1)

- Show all