Search results

October 10, 2023

Disentangling business- and tax-motivated bilateral royalty flows

November 17, 2020

Belastingontduiking en vermogensongelijkheid

January 24, 2019

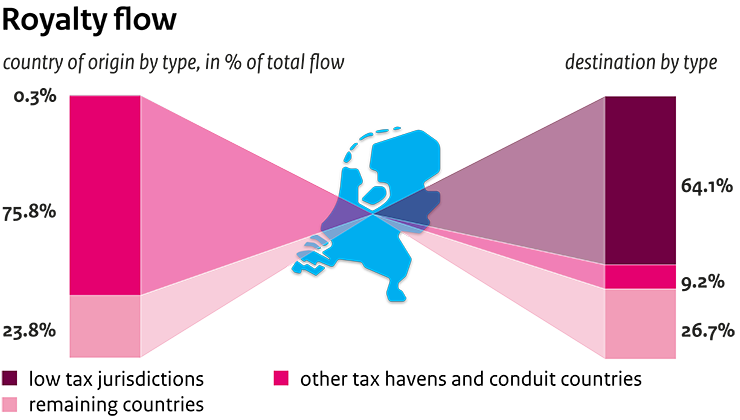

Conduit country the Netherlands in the spotlight