Publications

Year

Author

- Egbert Jongen (4)

- Arjan Lejour (3)

- Michiel Bijlsma (3)

- Remco Mocking (3)

- Roel van Elk (3)

- Rudy Douven (3)

- Wiljan van den Berge (3)

- Adam Elbourne (2)

- Ali Palali (2)

- Annemiek Verrips (2)

- Bas Straathof (2)

- Benedikt Vogt (2)

- Frits Bos (2)

- Gerbert Romijn (2)

- Henk-Wim de Boer (2)

- Joep Steegmans (2)

- Johannes Bollen (2)

- Jonneke Bolhaar (2)

- Joris de Wind (2)

- Krista Hoekstra (2)

- Marielle Non (2)

- Ona Ciocyte (2)

- Peter Zwaneveld (2)

- Rinske Windig (2)

- Rob Aalbers (2)

- Albert van der Horst (1)

- Andrei Dubovik (1)

- Anne Marieke Braam (1)

- Annette Zeilstra (1)

- Arne Brouwers (1)

- Bart Voogt (1)

- Bastiaan Overvest (1)

- Bert Smid (1)

- Clemens Kool (1)

- Debby Lanser (1)

- Ed Westerhout (1)

- Emile Cammeraat (1)

- Gabriella Massenz (1)

- Gerard Verweij (1)

- Gerdien Meijerink (1)

- Hugo Rojas-Romagosa (1)

- Ioulia Ossokina (1)

- Jan Boone (1)

- Kan Ji (1)

- Karel Boxhoorn (1)

- Karen van der Wiel (1)

- Katarzyna Grabska (1)

- Laura van Geest (1)

- Leon Bettendorf (1)

- Maarten van 't Riet (1)

- Minke Remmerswaal (1)

- Nicole Bosch (1)

- Paul Besseling (1)

- Paul Verstraten (1)

- Rob Luginbuhl (1)

- Ron van der Heijden (1)

- Sander Hoogendoorn (1)

- Sander van Veldhuizen (1)

- Sijbren Cnossen (1)

- Stefan Groot (1)

- Tatiana Kiseleva (1)

- Thomas van der Pol (1)

- Show all

April 5, 2017

Optimal Tax Routing: Network Analysis of FDI diversion

The international corporate tax system is considered as a network and, just like for transportation, ‘shortest’ paths are computed, minimizing tax payments for multinational enterprises when repatriating profits. We include corporate income tax rates, withholding taxes on dividends, double tax treaties and the double taxation relief methods. →

March 24, 2017

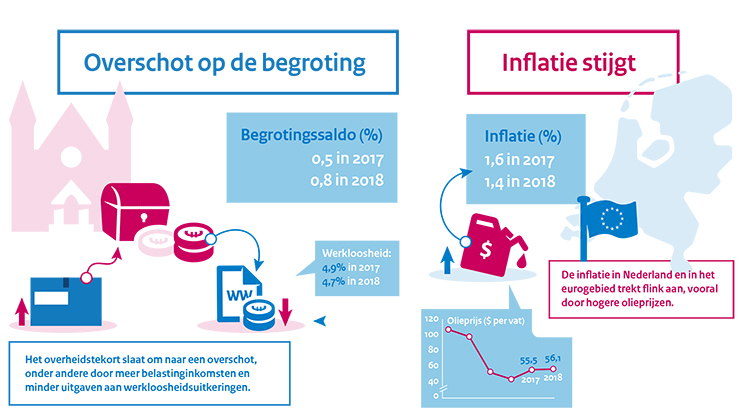

Central Economic Plan (CEP) 2017

March 24, 2017

The role of inflation-linked bonds

March 16, 2017